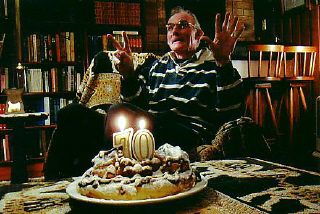

Our good friend and neighbour Ian had his 70th birthday on May the 22nd but as Padma was still away in Indonesia at that time, we celebrated the big event on June the 22nd. The "BIG 70"!

Our good friend and neighbour Ian had his 70th birthday on May the 22nd but as Padma was still away in Indonesia at that time, we celebrated the big event on June the 22nd. The "BIG 70"!

My own "BIG 60" celebrations aren't far away either! This - and last year's huge tax bill - prompted me to look at superannuation. The economist Keynes once said that paying taxes is the membership fee we pay for living in a civilised society. I'm old-fashioned enough to believe in this and I've often wondered how tax avoiders can bring themselves to use the roads, schools, hospitals, parks and other vital amenities and services for which they expect others to pay. However, the tax-man is offering some quite legal and generous tax concessions provided we take responsibility for our own old-age pensions. I have always thought the regulation so bewildering and the tax rules so complex as to be little more than a bonanza for super funds and tax accountants and lawyers.

However, after some reading I came to the conclusion that I could run my own Self-Managed Superannuation Fund and got everything signed, sealed and delivered, as they say, before the end of this tax year. The rules are complex but can be briefly summarised as follows:

1) The first $5,000 of all contributions into a super fund are tax-deductible plus, depending on age, 75% of all other contributions, up to the following limit:

| Income year | Under age 35 | Age 35 to 49 | Age 50 and over |

| 2004–05 | $13,934 | $38,702 | $95,980 |

2) The tax-man also offers concessional tax rates on money inside the fund:

|

3) Of course, the tax-man doesn't want you to stash all your money away into superannuation and thus rob him of all his revenue. However, he allows you what he considers " Reasonable Benefits" with the following limits:

|

There's a lot more to it than this but reading up on it and understanding it isn't as difficult as it may seem at first glance so if you haven't got your own super fund up and running yet, go for it!

Best wishes and from us all!

Peter & Padma & Malty & Rover

& Rover

riverbend@batemansbay.com

10 July 2005

P.S. There has been the most astonishing sequel to this: being a member and trustee of the superfund, I am not allowed to prepare the fund's tax return or audit its books myself but must engage the services of a third party. I contracted a firm in Sydney which describes itself as "Superannuation Accounting" and deals, as their name suggests, in nothing but superannuation accounting and taxation matters. In short, they are the experts. When they presented me with the fund's tax return for signature, I noticed that they had calculated income tax on the GROSS amount of super contributions rather than the tax-deductible portion of it - see paragraphs 1) and 2) above - and I immediately queried this with them. Repeatedly! Their reply was - repeatedly! - that contribution tax was payable on the GROSS amount. They even telephoned me to give me this advice again after I had continued to question their calculations. I had done my own reading on the matter and just couldn't take "No" for an answer until I finally found a webpage by the National Bank which not only confirmed my point but even explained it with a practical example. They finally consented. Here is their emailed reply:

| 4 October 2005 Dear Peter, Thanks for that. I have read the legislation. I think you are right. Deepest apologies, my interpretation of the law was incorrect s274 which says that 15% but then there is this 82AAT which excludes it from being tax (only the deductible amount will be taxed) – the 82 AAT notice thing. Really appreciate that, now I have to go fix up a couple of returns. Really, thank you for this. Really appreciate it. Owe you one. I will forward you an amended return for your signature today. Regards |

The difference is several thousand dollars of tax money I would have given away for nothing! It makes me wonder what sort of professional standards these guys have. My persistence has saved them from possible legal action and action for professional misconduct. Just as well they are not practising as doctors!!! The moral of this story? Don't believe everything the socalled "experts" tell you. Keep questioning things! Do what I do: put into practice Rudyard Kipling's little poem

| (They taught me all I knew) Their names are What and Where and When And How and Why and Who. |